Business Strategy & Development

Consider an Incentive Plan that Works for Your Firm.

If your law firm can give a bonus this year, “Congratulations!” And even if you’re weighing the possibility, that’s an encouraging sign of your firm’s potential.

But now that you’re the managing partner of a profitable small law office to mid-sized law firm, you will face new business decisions that your law school education didn’t cover. One is employee incentives and their impact on attracting and retaining talent at your firm.

How Firms Should Approach Bonuses

If you’ve had a successful year, an end-of-the-year annual bonus for your associates and support staff is a great way to thank them for their hard work and contributions. With the recent upheaval in the labor market, Biglaw and boutique firms are riding the trend of utilizing attractive bonus packages. Many are even competing with and exceeding the Cravath scale.

Providing an annual bonus can be a great morale booster, but it’s not a decision you should make on a whim. How will you structure the bonus? What happens next year if your firm isn’t as profitable? What happens if one of your attorneys leaves a week after you’ve paid the bonus? There are many questions you should consider as you decide which incentive plan will work best for your law firm.

What Type of Bonus Should Your Firm Use?

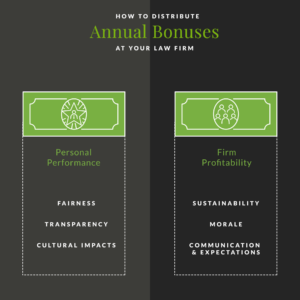

First, you’ll want to consider if you’ll offer a bonus based on personal performance, firm profitability or a combination of the two.

Attorney Performance Bonuses

One of the most conservative methods is to provide an annual bonus based on an attorney’s contribution to the firm’s bottom line. This provides lawyers with a great deal of incentive throughout the year, as their bonus is based almost entirely on their personal performance rather than the total profitability of your law firm.

With performance bonuses, you’ll want to ensure you’re being as transparent as possible with your associates. This means having a clearly defined rationale for measuring performance. You should also consider the cultural impacts on your firm.

Are Performance Bonuses Fair?

If you base a lawyer’s bonus on performance, it’s important to determine how you will measure success. If your firm operates with billable hours requirements, this provides an objective way to determine bonuses.

Just be careful about creating bonuses for associates who exceed their billable hours. This can create a culture where attorneys feel they need to overwork themselves. With the current emphasis on work-life balance influencing people’s employment decisions, this stress could backfire. But if your associates are expected to bring new business to the firm, you can also use this to determine bonuses.

You Can Mix Subjective & Objective Factors

There is no math equation for the perfect law firm bonus plan, but it’s not uncommon to consider various objective and subjective elements. This can be unique to the firm and the core values you want to advance, such as work ethic, client relations, and professional recognition. However, you should try to measure the factors you select as dispassionately as possible.

One way to illustrate what a lawyer can do to exceed in these areas is to provide clear examples of things that would warrant monetary recognition.

For instance, you may put a premium on the professional development of your newer associates. By showcasing that longer-tenured can be awarded bonuses (at least, in part) for effective mentorship, you can build up your roster without neglecting the contributions of senior members.

Make Bonus Plans Transparent

For performance-based bonuses, transparency is essential. Attorneys should never be surprised by their bonuses and should be provided with a clear understanding of how it’s calculated.

Performance-based bonuses may mean you can’t offer a bonus to everyone at your firm. That’s okay if it’s clear to every associate.

First-year lawyers will not contribute as much to your profitability, but being up-front about bonus requirements will still motivate newer associates. Plus, they’ll know what to work towards to become bonus-eligible.

What’s The Cultural Impact on the Firm

One drawback of a bonus based solely on individual performance is that it can create a competitive culture. Some law firms are okay with that and believe the competitive culture leads to more success and, ultimately, higher profits. But if you’d like to build more of a team culture at your firm, you may want to consider a different incentive plan.

Annual Bonuses Based on Law Firm Profitability

Another option is to offer a bonus based on the law firm’s revenues or profits. As a partner, this relieves the pressure of worrying about giving bonuses during less-profitable years. To do this, you’ll need to determine how much profit you need to provide the benefit comfortably.

Is The Bonus Plan Sustainable?

Remember that your profitability will vary based on your business’s stage. New law firms tend to be less profitable in the beginning as they incur more costs. Unexpected expenses, like an increase in rent in your office space, can also make a dent, especially in smaller law firms.

Larger, more established firms can easily predict their business revenue and profits, so providing a profit-based bonus is less risky if your firm falls into this category.

Communicate Expectations & Firm Goals

Like any incentive program, you need to be clear with the lawyers at your firm about how their bonus is determined. If you keep your business operations between you and your accountant, your attorneys will have no idea if they’re receiving a bonus or not.

You should provide some level of transparency throughout the year to help associates understand the health of the business and how the firm is pacing toward the ability to offer the annual bonus.

Profitability Bonuses Can Be Good for Morale

Profit-based bonuses create a team-like culture. However, you’ll need to decide how seniority will factor into your bonus. For example, a more senior-level attorney may not be happy about a newly hired, younger associate receiving the same bonus.

A profit-based bonus doesn’t necessarily mean everyone receives the same, fixed amount. You may want to consider a tiered system based on years with the firm and their level.

What About Less Profitable Times?

Offering a bonus during a profitable year may seem like a great idea to boost morale but remember that the opposite is true for years that business is not as profitable. Giving a bonus sets an expectation. Next year, you may incur unexpected costs that cut into the firm’s profitability. If you cannot give a bonus, associates may worry about the business’s health.

You Can Combine Elements of Both Plans

Of course, you can offer annual bonuses that combine firm profitability and individual performance. These are generally more complex but provide a good balance of accountability. During years when you may not have higher profits, you can still reward high-performing associates.

Things to Keep In Mind When Offering a Bonus

Before you decide on the formula for your incentive plan, taking a step back and evaluating the bigger picture is essential. An annual bonus is a means to show appreciation for your firm’s associates and will likely accomplish that. But you should ensure a bonus fits into your law firm’s business growth plan and benefits structure.

Ask yourself these questions before you consider giving bonuses.

1. Are Your Other Firm Benefits Competitive?

If you manage a small or mid-size law firm, you want to ensure you attract and retain your top talent. And in recent years, a lot of attention is now put on flexible hours, remote work, and PTO in addition to more traditional financial packages.

Not to downplay salary, 401K, and insurance, but if you’re considering an annual bonus, you shouldn’t view this decision in isolation. You’ll want to look at your benefits package, including other perks of working at your firm.

An annual bonus can be a great tool to keep your associates happy and motivated, but it won’t be effective if the rest of your benefits aren’t competitive with your local market.

2. What Do Your Attorneys Want?

As law firms grow, sometimes it can become more difficult for owners and managing partners to stay in the know on what’s important. A survey can help you understand if there are other areas you can improve to keep your associates happy.

Making partner. More time off. Better maternity leave.

There are countless benefits you could offer your associates, but do you know their current friction points? An annual bonus could be less important than something else you can provide as a benefit.

3. Can Your Firm Afford It (Right Now)?

If your firm is profitable enough for you to consider offering bonuses, you should already be consulting with an accountant. An accountant will help you see the bigger picture and understand an appropriate budget for your benefits package. Since a bonus falls into the category of benefits, be sure you understand the total expense you incur.

At a glance, it may seem like you can easily afford to provide an annual bonus. But does your law firm consistently underspend on other areas, like marketing budgets or technology? While it’s important to keep your associates happy and well-compensated, you may not be able to offer a bonus without sacrificing something else.

4. How Will You Reward Non-Lawyer Employees?

Most attorneys admit they wouldn’t know what to do without the firm’s support staff. From client case managers to assistants, and paralegals, as you consider a bonus structure, consider anyone employed by your firm, not just the attorneys. If you’re handing out sizable bonuses to the attorneys at your firm, does the gift basket you got everyone else send the right message?

5. Are You Feeling Pressure to Compete with Biglaw?

Biglaw’s lofty annual bonuses can make small to mid-size firm partners feel like they need to keep up. And the reality is that smaller firms are using annual bonuses to compete. It’s the nature of the market right now. Still, it’s important to remember that your firm may operate differently, and smaller firms in a more competitive area will have different concerns. The attorneys who work for you understand that.

An attorney wouldn’t expect the same bonus working for a large firm as opposed to most smaller ones, so you shouldn’t feel pressured to compete. Do what’s best for your law firm, and your associates will appreciate it.

6. Will Bonuses Be a Factor of Salary?

Most bonuses are set up to be a certain percentage of an associate’s salary. For larger firms, uniform pay scales provide transparency. Salaries for attorneys are based on a clear set of criteria, such as years of experience and background, so their bonuses will follow similar logic if they’re a percentage of salary.

Many smaller and mid-size firms don’t have as much rigor around salaries. If you create an annual bonus that’s a percentage of attorneys’ salaries, you need to make sure all those salaries are fair and consistent.

Select the Right Bonus for Your Firm.

While well-intentioned, the decision to offer a bonus at your law firm requires a lot of consideration. What works for the law firm across the street may not work for you, so take the time to carefully evaluate the decision and find the incentive plan that fits your firm size, culture, and revenue. If you have additional questions, our legal marketing agency has plenty of experience working with law firms and can help guide you and your law firm in decisions such as this.